How Can You Select Personal Loan in India – Do’s & Don’ts?

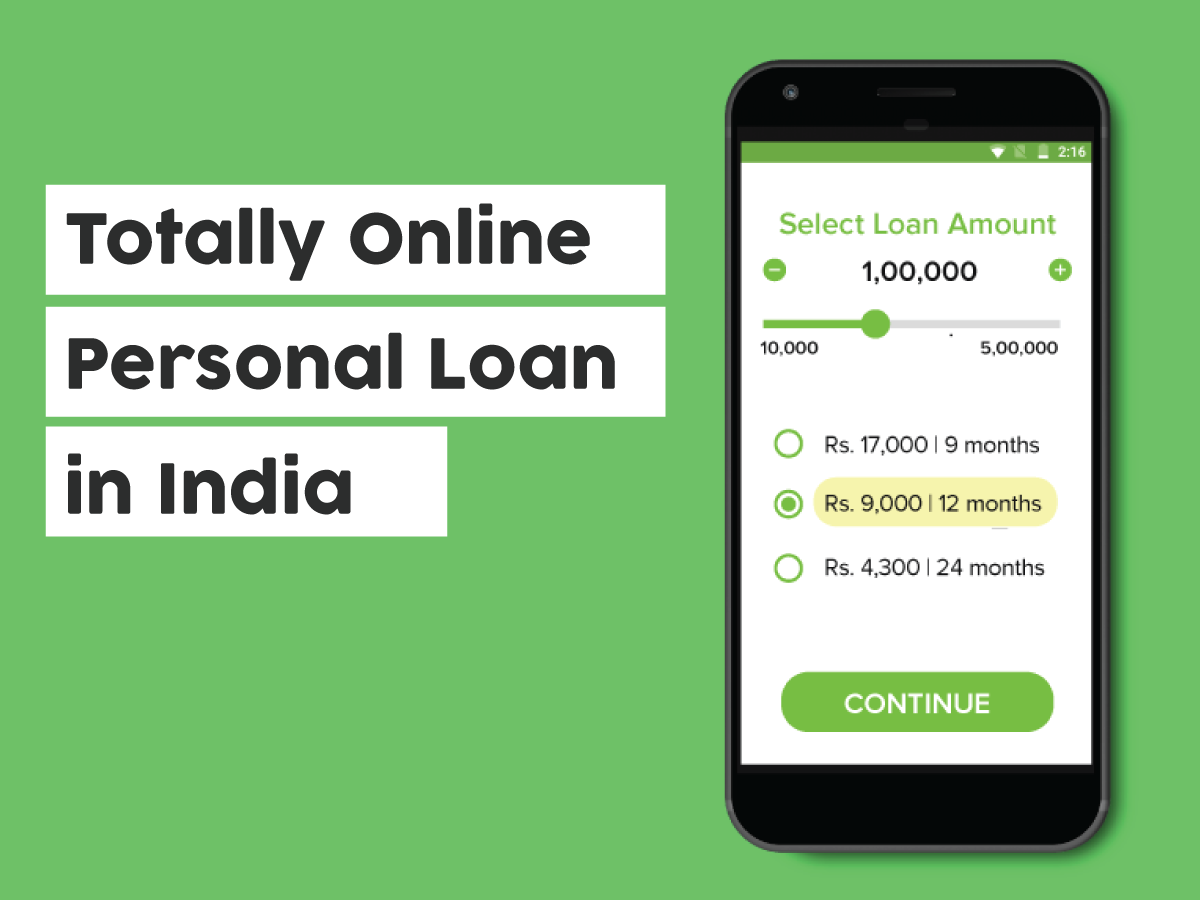

With a rapidly evolving and hyperconnected society, financial services have become increasingly accessible. Instant personal loan today in this advanced technology is just a click away. A personal loan is one of the most convenient choices for meeting your financial shortcomings. Fortunately, an instant personal loan does not require you to provide any documents. You can use this amount for any of your expenditures like renovation, wedding expenditures, debt consolidation, or vacation. With a personal loan, you do not require to specify where you will be utilizing your loan amount. Categorically, a personal loan is a kind of loan that can be used for any purpose, right from purchasing a video game to emergency medical funds for your parent.

Instant TATA Capital personal loan makes it simpler and easier to avail of the loan funds. This is because of the minimal documents required and quick disbursement post completing the procedure. The loan proceeds are transferred directly to the bank account in a matter of time. Personal loans come across as an aid for your short-term cashflows for your financial issues. Most individuals opt for the digital route for personal loans as the apps for a personal loan are safe, convenient, and easy to use. Note that, every single day, money lending is getting simpler owing to technological advancement. While personal loans are free from security or collateral, you must note that dos and don’ts to remain safe from unfair means and practices.

Also, note that TATA Capital personal loan allows you to check your TATA Capital personal loan status either by calling its customer care support or mailing it to its registered mail ID.

What are the top benefits of an instant personal loan?

In comparison to traditional loans, the turnaround time of instantaneous personal loan applications is super-fast. The average time for crediting the amount to the bank account is nearly 72 hours post which the application is approved.

An unsecured personal loan does not require any kind of security or collateral, and you do not require keeping anything as collateral. Generally, for an unsecured loan, lending companies do not dig for much. You just require a PAN card, Aadhaar card, or credit score for the application.

In the personal loan procedure, most lenders just ask you for the KYC documents, credit score, and income proof. To confirm if you are a legitimate individual with a legit income, they may contact your employer for any information they require.

Instant personal loans are advantageous in nature, specifically when you require an emergency fund for medical purposes, organizing a vacation, or any other purpose. It can cover your expenditures like medicines or tickets, doctor fees, travel, and food expenditures. Once your EMI begins, you can make the payment for your loan proceeds in the form of installments accordingly. Let’s just have a look at the must-do and must not do things while availing of a personal loan.

Things you must note

Compare different personal loan apps –

Every lender comes with its terms and conditions for a personal loan. You must ensure to review the interest being charged and the repayment tenure. In consideration of loans, comparing the loan rates will keep you thoroughly intact regarding the amount you must repay. If you are looking to compare your lender’s interest rate, you can check it online. If you want to compute your EMI proceed, then you can search for the personal loan EMI calculator. This will show you your EMI based on your loan proceed repayment tenure and rate of interest.

Go for the reasonable pay-off plan –

You can use the EMI calculator to understand if you can repay your amount. At times, people do take a massive loan amount, and then they do not have the potential to manage this. The bouncing of EMIs has two major disadvantages –

∙ You will require paying the bouncing fees, which again are more money that you must bear.

∙ Your credit score will be impacted negatively. The more default you make, your credit score will dip even more. With a low score, there will be lower chances of availing of a loan. So, repaying your loan EMI is important to keep your credit score high and your credit history clean.

Understand if you hold the eligibility criteria for availing a personal loan –

A personal loan is the simplest to avail of as the parameters by the lenders are restricted. The most common needs for a personal loan lending company are the need for KYC documents and bank statements to show your income proof and your credit score.

What are the things you must not do?

∙ Do not inquire a lot about your loan at a time –

You may be hunting for a suitable rate of interest, but this is not the way how it functions. If you want to check what the lending companies are charging as interest rates, you can simply check it up online on their respective website. The reason why you must not inquire a lot about the personal loan is that it may impact your credit score. This is because every time you place an application for a loan, your lender checks up on your credibility. As an outcome, experts often say you must not apply for distinct companies as this will impact your credit score massively.

∙ Avoid bouncing off your EMI –

Paying your EMI timely will keep your score fine and well. If you continue bouncing your EMI periodically, then your credit profile and your score will get impacted, which may make it tough to avail of a personal loan.

∙ Avoid borrowing a loan from any unlicensed lending company –

Many lenders provide loans with flashy offers that may attract the commoner. This kind of flashing offers look extremely beneficial, but they are generally not. There are incorrect financial practices that are widespread nowadays. You must be aware of those. Many companies are offering personal loans, and you must check to see if the company is registered. Availing of an urgent personal loan from any reputable company will keep you thoroughly safe from any financial fraud.

Ending note

A personal loan is looked upon as the best financial support during times of emergencies. It can be advantageous in any kind of financial requirement, right from planning vacations to medical exigencies. It is easy and quick to avail of an instant personal loan. However, while placing an application, ensure to know the dos and don’ts.